New bank for Samoa

To mark the 40th Anniversary of the Samoa Observer, a series of selected articles printed over the last 40 years will be re-published in the next two weeks, to show our readers the issues covered by this newspaper over the years and the personalities that made the headlines.

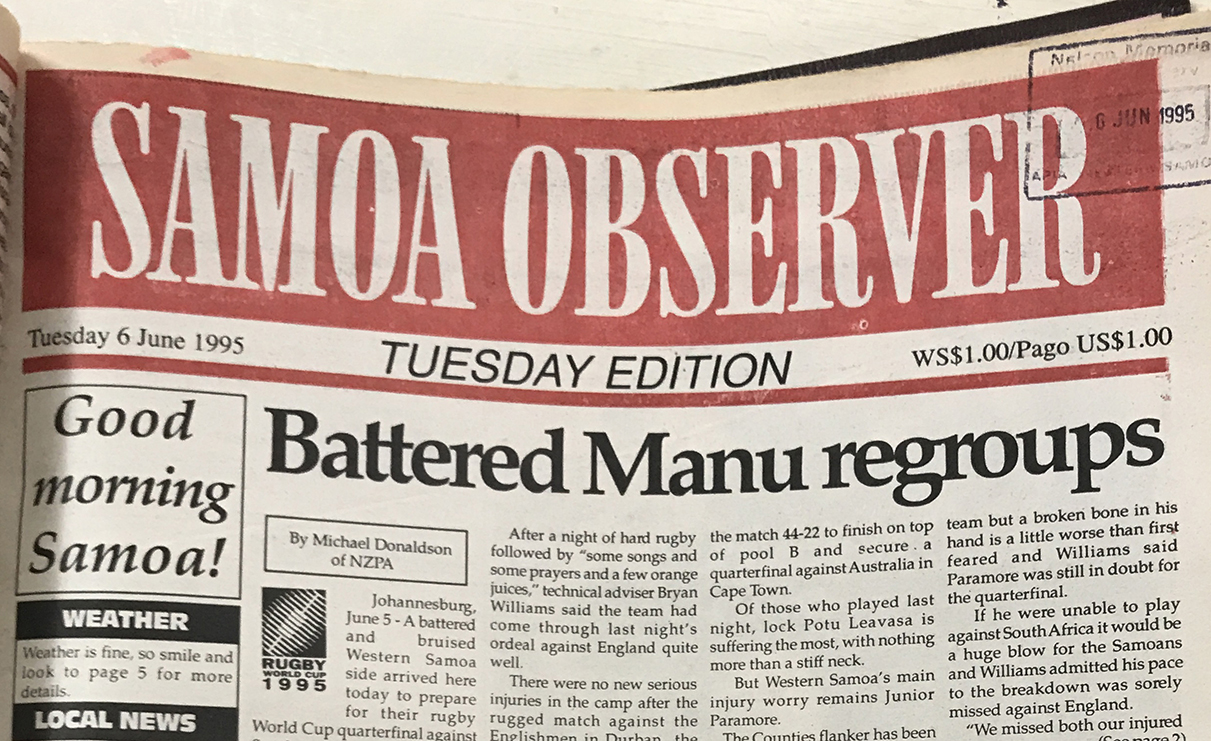

First Published: 06 June 1995

A group of locals has been granted a conditional license to set up a third commercial bank in Western Samoa.

The National Bank of Western Samoa may begin business as early as October or November and is expected to lead to more competitive bank rates and services for customers.

The bank will be 100 per cent locally owned, with shareholders including members of the Meredith family and a group of Pago residents.

Plans to set up the bank were announced by the Finance Minister, Tuilaepa Sailele in his budget statement to Parliament last Wednesday.

He said the move would promote healthy competition with the Central Bank and Bank of Western Samoa.

“With this positive step, we believe that this is the right time for Western Samoa to move away from direct controls to indirect and market-oriented approaches to monetary policy”, he said.

“Accordingly, the Central Bank has already initiated action...to gradually decontrol the financial system.”

The Governor of the Central Bank, Papalii Tommy Scanlan, said yesterday that the National Bank had until September to fulfil the Central Bank’s requirements in regard to start up capital and other conditions.

If the shareholders fulfilled those requirements, the bank would be granted a full license, he said.

A third commercial bank would give people more banking options and provide competition in terms of bank fees and other services, he said.

“The Central Bank fixes the maximum lending rates, so they (the National Bank) can set lower rates if they want. It will provide incentives.”

Papalii said the Central Bank issued invitations for banking license applications last year in New Zealand, Australia and Malaysia.

He said five “serious” applications were received and the National Bank of Western Samoa was selected after thorough checks of those involved.

“We don’t just issue a bank licence to anybody. The directors and shareholders have to be people of high repute, trustworthy and of high integrity.”

There was no bias towards either an overseas or local company winning the license and the local company happened to be the best, said Papalii.

The capital to set up the bank would come from shareholders, he said, but did not give further details.